When Inspire Medical Systems (stock: INSP) received FDA approval over a decade ago, it felt like a turning point for obstructive sleep apnea (OSA) treatment. For years, OSA therapy meant CPAP—and little else. For many patients, and clinicians, it wasn’t enough. Inspire's hypoglossal nerve stimulator offered something new: a surgically implanted device that could provide meaningful improvement without a mask.

The pitch was simple and elegant. And for many patients—and the surgeons treating them—it was transformative.

Explosive Growth

Over the next several years, Inspire rode a powerful wave of untapped need. The company scaled up its marketing, trained hundreds of surgeons, and built a brand recognizable far beyond medical circles. And that hype was backed by real-world outcomes: Peer-reviewed studies and registry data validated the device’s impact. Sleep clinics, ENTs, and patients alike began to see Inspire as the “Tesla of sleep”—innovative, sleek, and indispensable. Revenue soared.

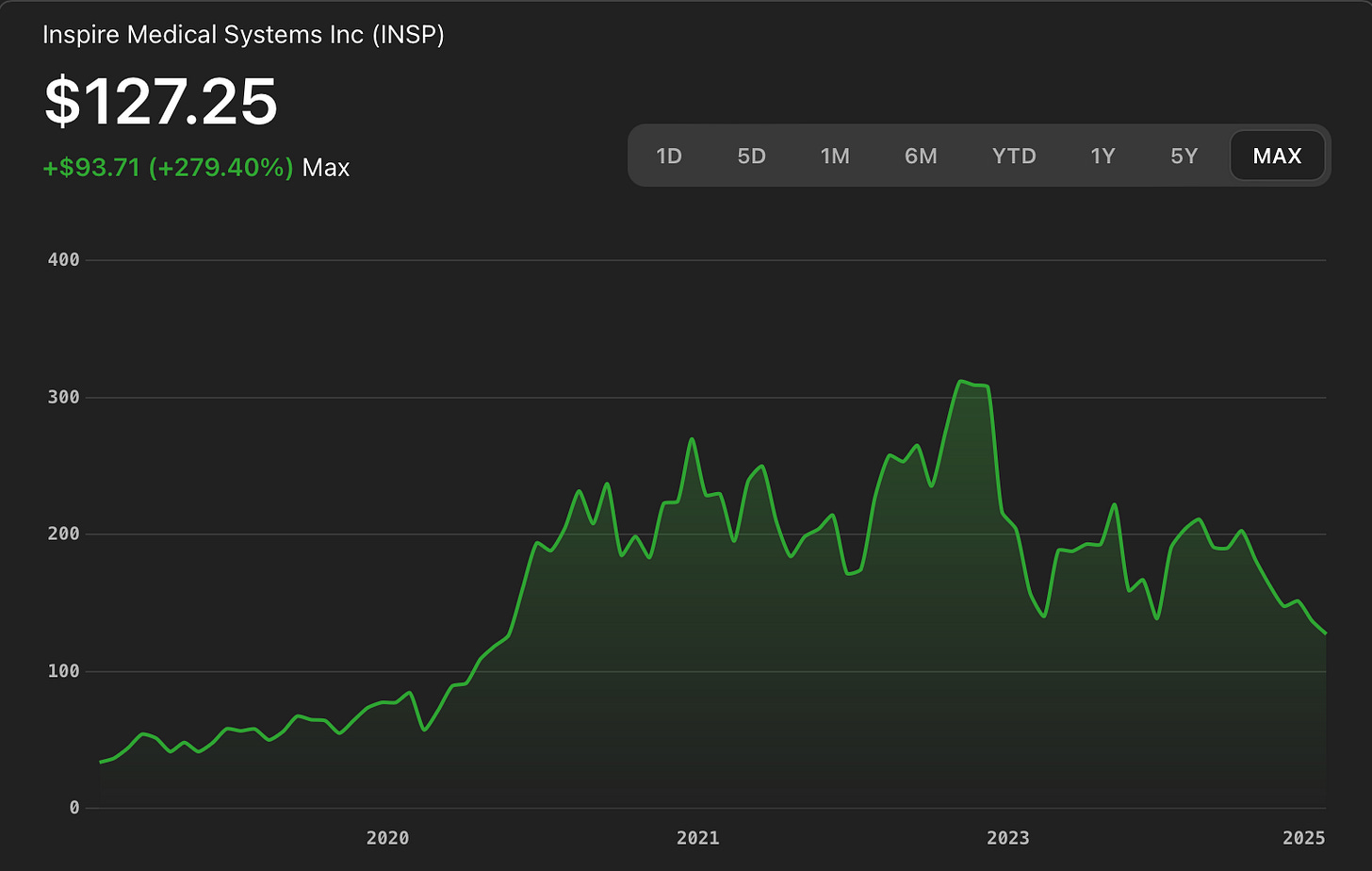

And Wall Street noticed. From its 2018 IPO through 2022, Inspire's stock price climbed from $24 to over $280 per share. It is one of the great medtech growth stories of the past decade. In many ways it represented the evolution of OSA as a boring disease of overweight males, to a multibillion dollar, venture-rich space essential to long-term health and qualify of life.

Stagnation

But fast-forward to today, and the tone is different.

While Inspire continues to generate strong revenue and owns a monopoly in its surgical niche, its growth curve is flattening. Q1 2025 earnings were steady, but analysts were disappointed with cautious guidance. The stock is flat since 2022.

-This diagram shows the explosive growth of the stock from IPO through 2021, and stagnation since.

What Has Changed? A New Landscape for Sleep Apnea

1. GLP-1 Agonists:

Drugs like semaglutide (Ozempic) and tirzepatide (Zepbound) are reshaping treatment for obesity—and, concurrently, for OSA. Weight loss can dramatically reduce AHI in some patients, especially in those with moderate to severe OSA. While morbidly obese are typically excluded from surgical procedures, more modestly overweight patients will face a choice: weight loss medication or surgical implant?

2. Surgical Competition:

Two new hypoglossal nerve stimulation surgeries will likely receive their FDA approval this year. I summarized them in a prior post here.

Nyxoah Genio

Livanova Aura6000

Both surgeries are also targeting a segment Inspire currently CAN’T treat: complete concentric collapse (CCC), a contraindication to its implant. If these devices receive approval for this indication - and thus far the data looks promising - this would unlock a larger pool of potential patients, and bypass patients requiring sleep endoscopy pre-op.

3. Pharmaceutical Disruption:

A once-daily OSA medication from Apnimed, recently released promising Phase 3 data recently. Likely to be FDA approved in 2026, it could appeal to CPAP-intolerant patients who are reluctant to pursue surgery. It’s not a direct replacement for Inspire—but yet another treatment option for Inspire-candidates to consider.

Need to demonstrate efficacy in clinically relevant outcomes.

There is a growing urgency by all stakeholders for OSA treatments to demonstrate improvement in cardiovascular and other clinical endpoints beyond sleep study surrogate metrics, such as AHI.

The Bullish Counterpoints

While these headwinds are real challenges to ongoing strong growth, Inspire is here to stay.

First-mover advantage matters. Inspire has trained physicians, long-term safety data, direct-to-consumer name recognition, and insurance infrastructure already in place. The counter is that this has been in an environment of zero competition.

The market is enormous. Tens of millions of Americans have OSA, and Inspire’s penetration is still relatively low. Even with competition, there's room to grow. The counter is that there are only so many sleep surgeons, operating venues and well trained teams for long term follow-up.

New tech is coming. The recently released Inspire V system allows quicker implantation. The company has said there is pent up demand for this new model. The counter is it’s unclear how many additional cases the new generation will generate for surgeons/company (how many surgeons would be able to do additional cases with the modest time-savings?) and most surgeon backlogs have been present for a while (rare that a patient/surgeon would actually wait to implant the V if there is indeed a backlog for the cases).

Final Thoughts

Inspire isn’t just a sleep apnea device—it helped create the modern sleep surgery category. But as obesity care is reshaped by GLP-1s, as new surgical players enter the ring, and as medications inch closer to approval, Inspire must adapt to maintain its success.

The question isn’t whether Inspire works—it does. The question is whether it will remain the dominant CPAP alternative, or become just one of many tools in an increasingly crowded toolbox.

Time—and data—will tell.

-Chris and Robson